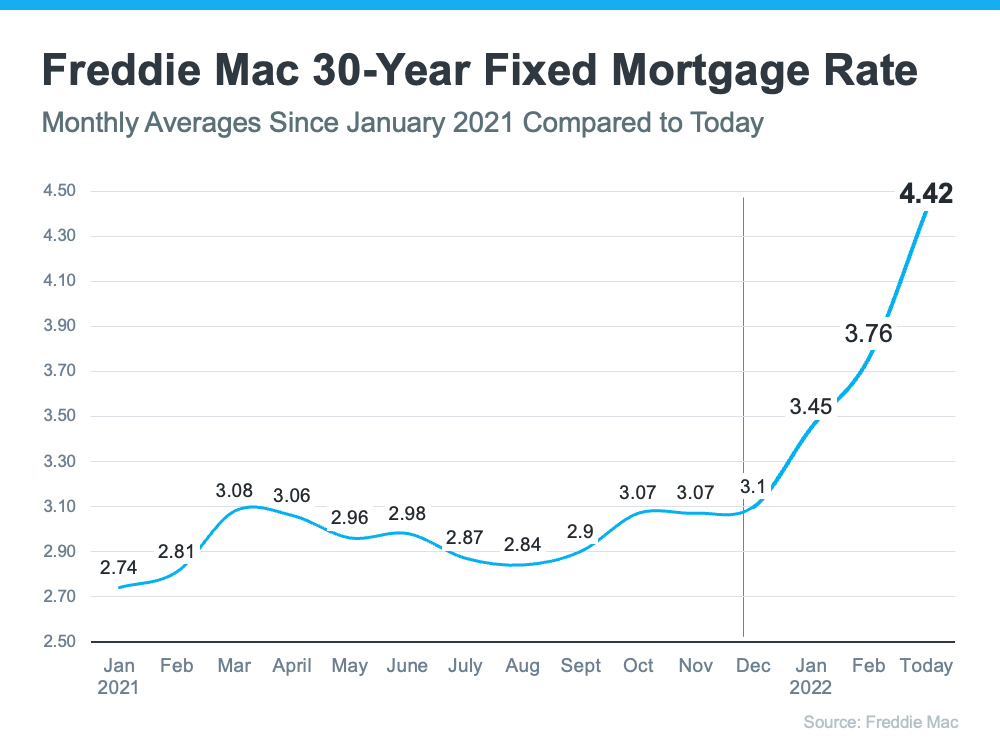

With the undeniable growing demand for homes on the market comes the fluctuation of mortgage rates. Mortgage rates are increasing faster than many economic experts have anticipated. The data pulled from Freddie Mac indicates that the average 30-year fixed-rate mortgage has grown by 1.2% (now 4.42%) since the beginning of this year. The mortgage Bankers Associate had predicted that the average would climb to 4.5% in 2022 and it has. This infographic best depicts the rapid climb of mortgage rates this year.

According to Sam Khater, Chief Economist at Freddie Mac, said in a recent press release: “This week, the 30-year fixed-rate mortgage increased by more than a quarter of a percent as mortgage rates across all loan types continued to move up. Rising inflation, escalating geopolitical uncertainty, and the Federal Reserve’s actions are driving rates higher and weakening customers’ purchasing power.”

When mortgage rates go up, home shoppers’ buying power decreases. Instead of being outbid by a competing buyer, we’re seeing rates grow at such rates that buyers are getting completely priced out of the market. This instance lessens the demand on the housing market and ultimately pushes home price growth down, right? Wrong, the prices of homes are not expected to fall, in fact, they’re expected to rise even more than the previous year.

Financial experts and their forecasts and opinions continually point to a gradual increase.

Nadia Evangelou, Senior Economist and Director of Forecasting, National Association of Realtors (NAR) said: “While higher short-term interest rates will push up mortgage rates, I expect some of this impact to be migrated eventually through lower inflation. Thus, I expect the 30-year fixed mortgage rate to continue to rise, although we aren’t likely to see the big jumps that occurred over the past weeks.”

Bottom Line for Brevard Homeowners.

If you’re in a position to buy a home, now will always be the best time compared to the future because navigating the housing marketing and rushing mortgage rates is always unpredictable. Measure how much you’re willing to risk because waiting to list your will home will always cost you more. Let’s connect today to discuss how you can benefit from today’s sellers’ market. With four decades in real estate and the resources & skills clients demand, I am happy to show you the art of selling (or buying) a home.